"Small Business Hazard Insurance: What It Really Covers" delves into the intricacies of insurance coverage for small businesses, shedding light on what hazards are protected and why it's crucial for business owners.

The following paragraphs will explore the specifics of what is typically covered, exclusions to be mindful of, how to choose the right policy, filing claims, cost considerations, and more.

Introduction to Small Business Hazard Insurance

Small business hazard insurance is a type of insurance that provides coverage for various risks or hazards that could potentially impact a small business. These hazards can include natural disasters, theft, vandalism, fire, and other unexpected events that may cause damage to the business premises, inventory, or equipment.

Examples of Hazards Covered

- Natural Disasters: This can include events such as floods, earthquakes, hurricanes, or tornadoes that may cause damage to the business property.

- Theft and Vandalism: Small businesses are at risk of theft or vandalism, and hazard insurance can help cover the cost of repairs or replacements.

- Fire Damage: Fires can be devastating for small businesses, and having hazard insurance can help cover the damage caused by a fire.

Importance of Hazard Insurance for Small Businesses

Hazard insurance is crucial for small businesses as it provides financial protection against unforeseen events that could potentially lead to significant financial losses. By having hazard insurance in place, small business owners can have peace of mind knowing that they are covered in case of emergencies, allowing them to focus on running and growing their business without worrying about unexpected costs.

Coverage Details

Small business hazard insurance typically covers a range of hazards that could potentially damage or disrupt a business's operations. These hazards may include fire, theft, vandalism, natural disasters, and other unexpected events that could impact the business's physical property or assets.

Types of Hazards Covered

- Fire Damage: Small business hazard insurance usually covers damages caused by fires, including structural damage and loss of inventory.

- Theft and Vandalism: Protection is provided for losses resulting from theft or vandalism, such as stolen equipment or property damage.

- Natural Disasters: Coverage may extend to events like floods, earthquakes, hurricanes, or tornadoes, depending on the policy.

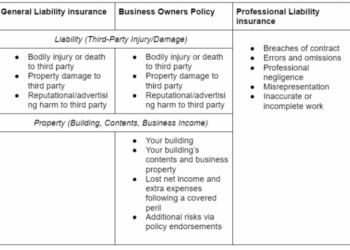

Comparison of Coverage Options

- Basic Coverage: Some policies offer basic coverage for common hazards like fire and theft, providing essential protection for small businesses.

- Comprehensive Coverage: Other policies may offer more comprehensive coverage, including protection against a wider range of hazards such as natural disasters.

Examples of Coverage Usage

Small business hazard insurance can come in handy in various situations, such as:

- Recovering from a fire that damages the business premises and equipment, allowing the business to rebuild and replace essential assets.

- Replacing stolen inventory or equipment, ensuring that the business can continue operations without significant disruptions.

- Repairing damage caused by vandalism, maintaining the business's reputation and appearance to customers.

Exclusions and Limitations

When it comes to small business hazard insurance, it is crucial for business owners to understand the exclusions and limitations in their policies. By being aware of what is not covered and the restrictions on coverage, they can take necessary steps to mitigate risks effectively.

Common Exclusions in Small Business Hazard Insurance

- Damage caused by intentional acts: Small business hazard insurance typically does not cover damage that is deliberately caused by the insured or anyone associated with the business.

- Natural disasters: Some policies may exclude coverage for certain natural disasters such as earthquakes, floods, or hurricanes. Business owners in high-risk areas should consider additional coverage for these events.

- Wear and tear: Normal wear and tear on a property or equipment is usually not covered by hazard insurance. It is important for business owners to maintain their property to prevent such damage.

- Neglect or lack of maintenance: Insurance policies may not cover damage resulting from neglect or lack of proper maintenance. Regular upkeep of the property and equipment is essential to avoid being denied coverage.

Limitations on Coverage

- Policy limits: Small business hazard insurance policies have limits on the amount of coverage provided. Business owners should ensure that the coverage amount is sufficient to protect their assets adequately.

- Deductibles: Business owners are usually required to pay a deductible before the insurance coverage kicks in. It is important to choose a deductible amount that is manageable for the business.

- Specific perils: Some policies only cover specific perils listed in the policy. Business owners should carefully review their policy to understand what is and isn't covered.

- Business interruption: While some policies may cover property damage, they may not include coverage for business interruption due to the damage. Business owners can consider adding business interruption insurance to their policy for additional protection.

Choosing the Right Policy

When it comes to selecting the most suitable hazard insurance policy for your small business, there are several key factors to consider. It's essential to make an informed decision to ensure that your business is adequately protected in case of any unforeseen events.

Key Factors to Consider

- Assess Your Risks: Identify the specific hazards that pose a threat to your business, such as natural disasters, theft, or accidents. Understanding your risks will help you determine the coverage you need.

- Coverage Options: Look into the different types of hazard insurance policies available, such as property damage, liability coverage, and business interruption insurance. Choose the ones that best suit your business needs.

- Cost vs. Coverage: Compare the costs and coverage limits of different insurance policies. Make sure you strike a balance between affordability and adequate protection for your business.

- Claims Process: Evaluate the ease and efficiency of the claims process of each insurance provider. A smooth claims process can make a significant difference during a crisis.

Importance of Regular Review and Updates

Regularly reviewing and updating your hazard insurance policy is crucial to ensure that it continues to meet the evolving needs of your small business. As your business grows or changes, your insurance requirements may also change. By staying up to date with your policy, you can avoid gaps in coverage and ensure that you are adequately protected at all times.

Filing a Claim

When it comes to filing a claim for small business hazard insurance, it is important to understand the process to ensure a smooth experience. Here are some tips to help you navigate through the claims process and common challenges that small business owners may face.

Understanding the Claim Process

- Notify your insurance provider as soon as possible after the incident occurs. This will start the claims process and allow the insurance company to begin their investigation.

- Provide all necessary documentation to support your claim, including photos, receipts, and any other relevant evidence of the damage or loss.

- Cooperate with the insurance adjuster and answer any questions they may have regarding the incident. Be honest and transparent throughout the process.

Ensuring a Smooth Claims Process

- Keep detailed records of all communication with your insurance company, including phone calls, emails, and letters. This will help you stay organized and track the progress of your claim.

- Follow up with your insurance provider regularly to check on the status of your claim and address any delays or issues that may arise.

- Seek assistance from a trusted insurance agent or advisor if you encounter challenges during the claims process. They can provide guidance and support to help you resolve any issues.

Common Challenges for Small Business Owners

- Disputes over coverage limits or exclusions in the policy can delay the claims process. Make sure you understand your policy and its limitations to avoid any surprises.

- Incomplete or inaccurate documentation can lead to claim denials. Double-check all information provided to ensure accuracy and completeness.

- Delays in receiving payment from the insurance company can impact your business operations. Stay proactive and follow up regularly to expedite the claims settlement.

Cost Considerations

When it comes to small business hazard insurance, the cost is determined based on various factors such as the type of business, location, coverage limits, and past claims history. Insurance companies assess the risk associated with insuring your business and calculate the premium accordingly.

Factors Affecting Cost

- Business Type: The nature of your business, its size, and the level of risk it poses can impact the cost of insurance. For example, a restaurant may have higher premiums due to fire hazards compared to a retail store.

- Location: The geographical location of your business plays a significant role in determining the insurance cost. Areas prone to natural disasters or high crime rates may have higher premiums.

- Coverage Limits: The higher the coverage limits you choose, the more expensive the insurance policy will be. It's essential to strike a balance between adequate coverage and affordability.

- Claims History: Your past claims history can influence the cost of insurance. A business with a history of frequent claims may face higher premiums.

Managing Insurance Costs

- Shop Around: Compare quotes from different insurance providers to find the best coverage at a competitive price.

- Bundling Policies: Consider bundling your hazard insurance with other business insurance policies to qualify for discounts.

- Risk Management: Implement safety measures and risk management practices to reduce the likelihood of claims, which can lead to lower premiums over time.

Financial Impact of Inadequate Coverage

Not having adequate hazard insurance can have a significant financial impact on your small business. In the event of a covered hazard such as a fire, natural disaster, or theft, you may be left with substantial out-of-pocket expenses to repair or replace damaged property, inventory, or equipment.

This can lead to financial strain, disruption of operations, and even the closure of your business if the losses are severe.

Last Recap

In conclusion, "Small Business Hazard Insurance: What It Really Covers" serves as a comprehensive guide for small business owners to navigate the complexities of insurance coverage, emphasizing the importance of adequate protection against unforeseen hazards.

Expert Answers

What are some common exclusions in small business hazard insurance policies?

Exclusions may include intentional acts, war, nuclear hazards, pollution, and wear and tear.

How is the cost of small business hazard insurance determined?

The cost is determined based on factors such as the type of business, location, coverage limits, and deductible chosen.

What should small business owners do to ensure a smooth claims process?

They should document the incident, notify the insurance company promptly, and provide all necessary information for the claim.