Embark on a journey to discover “How to Get Affordable General Liability Insurance in Europe” as we delve into the intricacies of finding cost-effective insurance solutions for your business. Get ready to explore the key factors, tips, and legal requirements that play a crucial role in securing the right coverage at the right price.

As we navigate through the realm of general liability insurance in Europe, you will uncover valuable insights and strategies to make informed decisions that benefit your business in the long run.

Researching Affordable General Liability Insurance in Europe

When looking for affordable general liability insurance in Europe, it is crucial to conduct thorough research to find the best coverage that meets your business needs while staying within budget.

Identifying Insurance Providers

- Start by researching different insurance providers in Europe that offer general liability insurance.

- Check their reputation, financial stability, and the range of coverage options they provide.

- Look for insurance companies that have experience working with businesses similar to yours.

Comparing Insurance Quotes

- Request quotes from multiple insurance providers to compare prices and coverage options.

- Consider factors such as coverage limits, deductibles, and any additional features included in the policy.

- Ensure that the insurance policy meets the legal requirements in the European countries where your business operates.

Reading Reviews and Testimonials

- Read reviews and testimonials from other businesses that have used the insurance providers you are considering.

- Pay attention to feedback on customer service, claims processing, and overall satisfaction with the insurance coverage.

- Use this feedback to make an informed decision when selecting an insurance provider for your business.

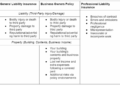

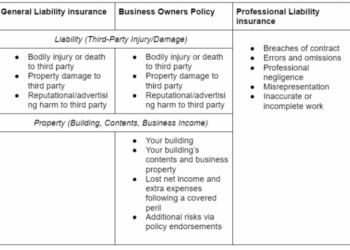

Understanding General Liability Insurance Coverage

General liability insurance is a crucial policy that protects businesses from financial losses resulting from lawsuits due to bodily injury, property damage, or advertising injury caused to others.

Coverage Options by Different Insurance Companies in Europe

- Company A: Offers coverage for bodily injury and property damage claims.

- Company B: Provides coverage for advertising injury and legal defense costs.

- Company C: Includes coverage for medical payments and personal injury claims.

Examples of Scenarios Requiring General Liability Insurance

- A customer slips and falls in your store, leading to a bodily injury claim.

- Your advertising inadvertently infringes on a competitor's copyright, resulting in an advertising injury lawsuit.

- An employee damages a client's property while working on-site, leading to a property damage claim.

Factors Affecting the Cost of General Liability Insurance

When it comes to determining the cost of general liability insurance in Europe, there are several factors that can have an impact on the premiums businesses have to pay. Understanding these factors is crucial for businesses looking to secure affordable coverage.

Business Size and Nature

The size and nature of a business play a significant role in determining the cost of general liability insurance. Larger businesses with more employees, higher revenue, and greater exposure to risks are likely to pay higher premiums. Similarly, businesses operating in high-risk industries such as construction or healthcare may face increased insurance costs due to the nature of their operations.

- The size of the business, including number of employees and revenue generated, can influence the risk profile assessed by insurance providers.

- The industry in which the business operates can impact insurance costs, with high-risk industries typically facing higher premiums.

- Businesses with a history of frequent claims or lawsuits may be considered higher risk and face higher insurance costs.

Tips for Saving Money on General Liability Insurance

When it comes to getting affordable general liability insurance in Europe, there are several strategies you can implement to save money and lower your insurance premiums. From negotiating with insurance providers to bundling policies, here are some tips to help you get the best deal.

Negotiate Lower Insurance Premiums

One effective way to save money on general liability insurance is to negotiate with insurance providers for lower premiums. You can highlight your business's safety measures, risk management strategies, and claims history to demonstrate that you are a low-risk client deserving of a more competitive rate.

Bundling Insurance Policies

Another way to save money on general liability insurance is by bundling your policies. By combining multiple insurance policies with the same provider, such as general liability, property, and commercial auto insurance, you can often secure a discounted rate. This not only saves you money but also simplifies your insurance management.

Importance of Good Business Credit Score

Maintaining a good business credit score is crucial for securing lower insurance costs. Insurance providers often take your credit score into account when determining your premium rates. By paying bills on time, managing debt responsibly, and improving your credit score, you can potentially reduce your general liability insurance costs significantly.

Legal Requirements for General Liability Insurance in Europe

In Europe, businesses are often legally required to have general liability insurance to protect themselves from potential financial risks associated with lawsuits, property damage, or bodily injuries. This type of insurance is designed to cover the costs of legal defense, settlements, and judgments if a business is found liable for causing harm to others.

Specific Regulations in Different European Countries

- In the United Kingdom, businesses are not legally required to have general liability insurance, but many choose to purchase it to protect their assets and reputation.

- Germany mandates that businesses have liability insurance to cover third-party damages up to a certain amount.

- In France, general liability insurance is required for certain professions, such as doctors and architects, to protect against malpractice claims.

Consequences of Not Having Adequate Coverage

- Without adequate general liability insurance coverage, businesses risk facing significant financial losses if they are sued for negligence, property damage, or other liabilities.

- Legal fees, settlements, and damages awarded in court can quickly add up and bankrupt a business that does not have insurance to cover these expenses.

- Furthermore, not having general liability insurance can damage a business's reputation and credibility, potentially leading to a loss of customers and revenue.

Ultimate Conclusion

In conclusion, the path to obtaining affordable general liability insurance in Europe is paved with knowledge, research, and proactive decision-making. By understanding the nuances of insurance coverage, factors affecting costs, and money-saving tips, you can safeguard your business while keeping expenses in check.

Take charge of your insurance journey and ensure your business is adequately protected in the ever-evolving European market.

Key Questions Answered

What are the key factors to consider when comparing insurance quotes?

When comparing insurance quotes, key factors to consider include coverage limits, exclusions, deductible amounts, and any additional benefits offered by the insurance provider.

How can the size and nature of a business impact insurance premiums?

The size and nature of a business can impact insurance premiums based on factors such as revenue, industry risks, number of employees, and past claims history.

Are there specific regulations for general liability insurance in different European countries?

Yes, each European country may have its own regulations and requirements for general liability insurance, so it's essential to be aware of the legal obligations in the respective country where your business operates.