Delve into the intricate world of business insurance with a focus on comparing general and professional liability coverage. This guide will unravel the complexities and shed light on the essential differences between the two types of coverage, helping you make informed decisions for your business.

Explore the nuances of insurance coverage and gain valuable insights into the factors that play a crucial role in protecting your business from potential risks and liabilities.

Understanding Business General Liability Coverage

Business general liability coverage is a fundamental insurance policy that provides protection against a variety of common risks that businesses face on a day-to-day basis. It is designed to shield businesses from financial losses resulting from third-party claims of bodily injury, property damage, and advertising injury.

Basic Coverage Provided by General Liability Insurance

- Protection against bodily injury claims: General liability insurance covers medical expenses and legal fees if someone is injured on your business premises.

- Coverage for property damage: It includes protection for damages to someone else's property caused by your business operations.

- Advertising injury protection: This coverage safeguards your business against claims of libel, slander, copyright infringement, or false advertising.

Common Risks Covered by General Liability Insurance

- Slip-and-fall accidents on your business premises

- Product liability claims for defective products

- Damage caused by your employees while working off-site

Cost-Effectiveness of General Liability Insurance for Different Types of Businesses

While the cost of general liability insurance can vary depending on the size and nature of your business, it is generally considered a cost-effective investment for most businesses. Small businesses, in particular, can benefit from the financial protection and peace of mind that this coverage provides, especially when facing expensive legal claims or lawsuits.

Exploring Professional Liability Coverage

Professional liability insurance, also known as errors and omissions insurance, is a type of coverage that protects professionals from liability arising from mistakes or negligence in the services they provide. This coverage is crucial for professionals who provide advice or services to clients, as it helps cover legal fees and damages in case of lawsuits.

Professions Requiring Professional Liability Coverage

- Medical professionals such as doctors, nurses, and therapists

- Legal professionals including lawyers and paralegals

- Financial advisors and accountants

- Consultants in various fields

Importance of Professional Liability Insurance for Service-Based Businesses

Professional liability insurance is essential for service-based businesses because it provides protection against claims of negligence, errors, or omissions in the services they offer. Without this coverage, businesses risk facing costly legal battles that could potentially bankrupt them. By having professional liability insurance, service-based businesses can operate with peace of mind knowing they are financially protected in case of a lawsuit.

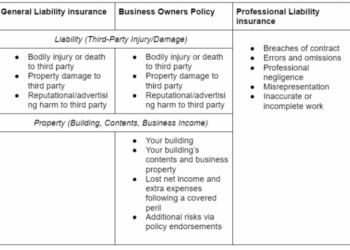

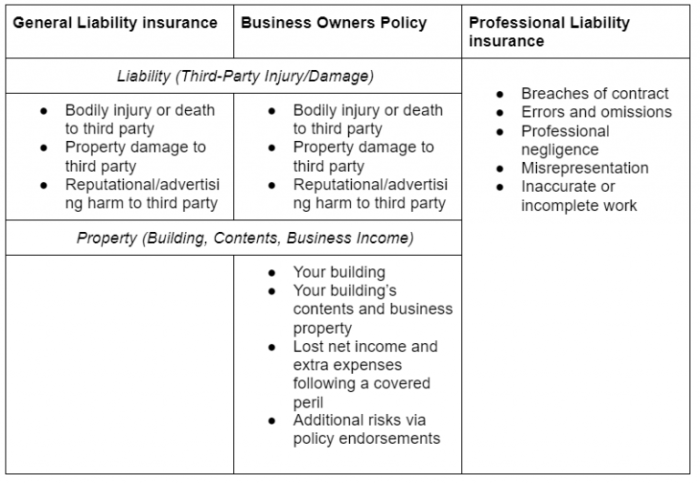

Key Differences Between General and Professional Liability Coverage

When comparing general liability and professional liability coverage, it's important to understand the distinct types of risks each insurance addresses. Let's delve into the key differences between these two essential forms of coverage for businesses.

Risks Covered

General liability insurance typically covers claims related to bodily injury, property damage, and advertising injury. This includes incidents like slip-and-fall accidents in your place of business or damage caused by your products. On the other hand, professional liability insurance, also known as errors and omissions insurance, focuses on claims related to professional services

This can include negligence, mistakes, or failure to perform services as promised.

Claims Scenarios

For general liability, common claims scenarios may involve a customer slipping on a wet floor in your store or a visitor getting injured by a product you sell. In contrast, professional liability claims often arise from errors in professional services, such as a consultant providing incorrect advice that leads to financial loss for a client.

When Both Types of Coverage Are Needed

There are scenarios where a business may require both general and professional liability coverage. For instance, a consulting firm might need general liability to cover potential slip-and-fall accidents in their office, while also needing professional liability to protect against claims of negligence or errors in their consulting services.

Having both types of coverage ensures comprehensive protection for different types of risks that a business may face.

Factors to Consider When Comparing Coverage

When comparing business general and professional liability coverage, there are several key factors to consider to ensure you select the most suitable option for your specific needs.

Role of Business Size and Industry

The size and industry of your business play a significant role in determining the most suitable coverage. Larger businesses with more employees and higher revenue may require higher coverage limits to adequately protect against potential risks. Additionally, the industry in which your business operates can impact the type of coverage needed.

For example, a healthcare provider may require more specialized professional liability coverage compared to a retail store.

Coverage Limits and Deductibles

Coverage limits and deductibles are crucial factors that impact the overall protection provided by your insurance policy. Higher coverage limits mean more financial protection in the event of a claim, but they also come with higher premiums. Deductibles determine the amount you must pay out of pocket before your insurance coverage kicks in.

It's essential to carefully evaluate your risk tolerance and budget when selecting coverage limits and deductibles.

Evaluating Insurance Providers

When comparing coverage options, it's essential to evaluate the reputation and financial stability of insurance providers. Look for insurers with a strong track record of customer satisfaction and prompt claims processing. Check their financial ratings from independent agencies to ensure they have the financial strength to pay out claims when needed.

Researching and selecting a reputable insurance provider can give you peace of mind knowing that your coverage is reliable.

Ending Remarks

In conclusion, understanding the distinctions between general and professional liability coverage is paramount for safeguarding your business's interests. By weighing the key differences and considering the essential factors, you can select the most suitable coverage that aligns with your specific business needs.

Empower yourself with knowledge and make informed choices to secure a stable future for your business.

Clarifying Questions

What are the key differences between general liability and professional liability coverage?

General liability insurance typically covers third-party bodily injuries and property damage, while professional liability insurance protects against claims of negligence or errors in professional services.

How can I determine the most suitable coverage for my business?

Consider factors such as your business size, industry risks, coverage limits, and deductibles when comparing general and professional liability coverage to choose the best option for your specific needs.

Are there scenarios where a business might need both types of coverage?

Some businesses, especially service-based ones, may require both general and professional liability coverage to ensure comprehensive protection against various risks.