Exploring the realm of “Health & Hazard: Dual Coverage Plans for Small Companies”, this introduction sets the stage for a detailed exploration of how small businesses can benefit from comprehensive coverage options.

The following paragraph will delve into the intricacies of dual coverage plans and shed light on their significance for small companies.

Introduction to Dual Coverage Plans

Dual coverage plans for small companies involve providing employees with both health and hazard insurance to ensure comprehensive protection in various situations.

How Dual Coverage Plans Work

- Employees are covered by both health insurance, which covers medical expenses, and hazard insurance, which provides protection in case of accidents or unforeseen events.

- This dual coverage ensures that employees have access to medical care and financial support in the event of injury or illness.

Advantages of Dual Health and Hazard Coverage

- Employees have peace of mind knowing they are fully covered in both health-related and hazardous situations.

- Employers can attract and retain top talent by offering comprehensive insurance coverage.

- Dual coverage plans can help reduce financial burdens on employees and their families in times of need.

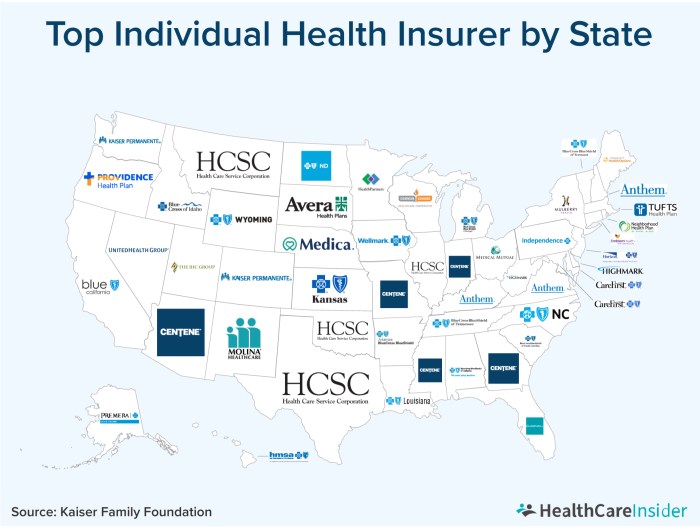

Health Insurance Options for Small Companies

Small companies have several health insurance options to consider when providing benefits to their employees. Offering health insurance benefits is crucial for attracting and retaining top talent, as well as promoting the overall well-being of the workforce.

Types of Health Insurance Plans

- Traditional Health Insurance: This type of plan typically offers the most comprehensive coverage but can be more expensive for both employers and employees.

- High-Deductible Health Plans (HDHPs): HDHPs have lower monthly premiums but higher deductibles, making them a more cost-effective option for some small companies.

- Health Maintenance Organization (HMO) Plans: HMOs require employees to choose a primary care physician and get referrals to see specialists, which can help control costs.

- Preferred Provider Organization (PPO) Plans: PPOs offer more flexibility in choosing healthcare providers but may come with higher out-of-pocket costs.

Importance of Offering Health Insurance Benefits

Providing health insurance benefits to employees not only helps attract and retain top talent but also promotes a healthy and productive workforce. Access to affordable healthcare can improve employee morale, reduce absenteeism, and increase job satisfaction.

Impact of Not Having Health Insurance

- Financial Burden on Employees: Without health insurance, employees may struggle to afford necessary medical care, leading to financial stress and potential medical debt.

- Reduced Productivity: Employees without health insurance may delay seeking medical treatment, resulting in more severe health issues that can impact their ability to work.

- Lack of Preventive Care: Without health insurance, employees may forgo preventive care services, increasing the risk of undiagnosed health conditions and higher healthcare costs in the long run.

Hazard Insurance Coverage for Small Companies

When it comes to protecting small businesses, hazard insurance plays a crucial role in safeguarding against unexpected events that could potentially lead to financial losses. Let's explore the types of hazard insurance coverage suitable for small companies and how it can provide much-needed protection.

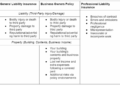

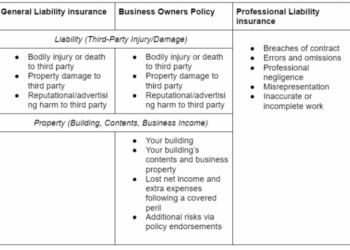

Types of Hazard Insurance Coverage

- Property Insurance: This type of coverage protects small businesses against damage or loss of physical assets such as buildings, equipment, and inventory due to hazards like fire, theft, or natural disasters.

- Liability Insurance: Liability coverage helps small companies handle legal costs and settlements in case they are held responsible for injuries or property damage to third parties.

Examples of Hazards Small Companies Should Consider Coverage For

- Natural Disasters: Events such as earthquakes, floods, hurricanes, and tornadoes can cause significant damage to small business properties and assets.

- Theft and Vandalism: Small businesses are often targets for theft and vandalism, making it crucial to have coverage for such incidents.

- Business Interruption: Hazard insurance can also provide coverage for lost income and expenses if a small company is forced to temporarily shut down due to a covered hazard.

How Hazard Insurance Protects Small Businesses

Hazard insurance acts as a safety net for small companies by providing financial support to repair or replace damaged property, cover legal expenses, and maintain business operations during challenging times. By having the right coverage in place, small businesses can mitigate risks and ensure continuity in the face of unforeseen events.

Integrating Health and Hazard Coverage

Integrating health and hazard coverage into a dual plan can provide small companies with comprehensive protection for their employees and business assets. By combining these two essential types of insurance, companies can streamline their coverage, reduce costs, and simplify the management of insurance policies.

Benefits of Integrating Health and Hazard Coverage

- Enhanced Risk Management: Integrating health and hazard coverage allows companies to address both employee well-being and property protection under a single plan, improving overall risk management.

- Cost Savings: Combining health and hazard coverage often results in discounted premiums from insurance providers, leading to cost savings for small businesses.

- Convenience: Managing a dual coverage plan is more convenient for small companies, as they only need to deal with one insurance provider and one set of policies.

Tips for Combining Health and Hazard Coverage

- Evaluate Insurance Needs: Assess the specific health and hazard risks faced by your company to determine the appropriate coverage levels for each area.

- Consult with Insurance Experts: Seek guidance from insurance professionals who specialize in dual coverage plans to help you navigate the complexities of combining health and hazard insurance.

- Customize Policies: Work with your insurance provider to tailor the dual coverage plan to meet the unique needs of your small business, ensuring comprehensive protection.

Best Practices for Managing Dual Coverage Plans

- Regular Reviews: Conduct periodic reviews of your dual coverage plan to ensure it aligns with your company's evolving needs and any regulatory changes.

- Employee Education: Provide clear information to employees about the health and hazard coverage included in the dual plan, helping them understand their benefits and how to access them.

- Claims Handling Procedures: Establish efficient procedures for handling health and hazard insurance claims to expedite the process and minimize disruptions to your business operations.

Final Thoughts

In conclusion, the discussion surrounding dual coverage plans for small companies emphasizes the importance of safeguarding employees against health and hazard risks, paving the way for a more secure and resilient work environment.

FAQ Section

What are the advantages of dual coverage plans for small companies?

Dual coverage plans provide a comprehensive safety net for employees, offering protection against both health-related issues and unexpected hazards.

How can small companies effectively combine health and hazard coverage?

Small companies can streamline the integration process by working closely with insurance providers to tailor a plan that meets their specific needs and budget.

Why is offering health insurance benefits important for small companies?

Providing health insurance benefits not only enhances employee satisfaction and retention but also contributes to a healthier workforce overall.