Embarking on the journey of “Customized Liability Insurance Packages for Global SMEs,” the narrative unfolds in a captivating manner, enticing readers with a promise of engaging and informative content.

Delving into the specifics, we shed light on the intricacies and importance of customizing liability insurance for small and medium enterprises operating on a global scale.

Introduction to Customized Liability Insurance Packages for Global SMEs

Customized liability insurance packages for SMEs are tailored insurance solutions designed to meet the specific needs and risks faced by small and medium-sized enterprises operating on a global scale. These packages offer comprehensive coverage that addresses the unique challenges and exposures that SMEs encounter in various industries.

Why Global SMEs Need Tailored Liability Insurance Solutions

Global SMEs operate in diverse markets and are exposed to a wide range of risks that may not be adequately covered by standard insurance policies. Tailored liability insurance solutions are essential for these businesses to ensure they are protected against potential financial losses resulting from lawsuits, accidents, or other unforeseen events.

Specific Risks Faced by Global SMEs in Different Industries

- Manufacturing Industry: Global SMEs in the manufacturing sector face risks such as product liability claims, supply chain disruptions, and equipment breakdowns that can impact their operations and profitability.

- Technology Industry: SMEs in the technology sector are vulnerable to data breaches, cyber attacks, and intellectual property disputes, highlighting the need for specialized liability coverage.

- Hospitality Industry: Global SMEs in the hospitality industry confront risks related to guest injuries, property damage, and liability claims arising from food or beverage services, necessitating customized insurance solutions.

Factors to Consider in Designing Customized Liability Insurance Packages

Understanding the unique risks faced by global SMEs is crucial in designing customized liability insurance packages. These businesses operate in diverse environments and face a variety of challenges that may not be present in larger corporations.

Industry-specific Factors

Industry-specific factors play a significant role in determining the design of liability insurance packages for SMEs. For example, a manufacturing company may have different risks compared to a technology startup. Insurance providers need to tailor coverage options based on the specific needs and vulnerabilities of each industry.

Geographical Location

The geographical location of an SME also influences the coverage needs for liability insurance. Businesses operating in regions prone to natural disasters or political instability may require additional coverage for property damage, business interruption, or liability claims. Understanding the risks associated with different locations is essential in providing comprehensive insurance solutions for global SMEs.

Coverage Options in Customized Liability Insurance Packages

When it comes to customized liability insurance packages for global SMEs, understanding the different coverage options available is crucial in protecting your business from unforeseen risks. Let's explore the common types of liability coverage and their significance for SMEs.

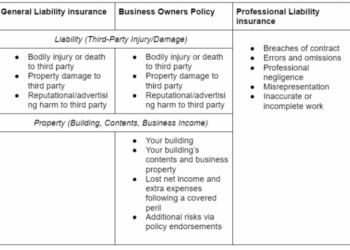

General Liability Insurance

General liability insurance provides coverage for third-party bodily injury, property damage, and advertising injury claims. It is a foundational coverage that protects SMEs from common risks such as slip-and-fall accidents or customer property damage.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, covers claims of negligence or inadequate work performance that result in financial loss for clients. This type of coverage is essential for service-based businesses that provide advice or professional services.

Product Liability Insurance

Product liability insurance protects SMEs from liability claims arising from defective products that cause harm or injury to consumers. It covers legal fees, settlements, and medical expenses associated with product-related incidents, providing financial protection for businesses that manufacture or sell goods.

Cyber Liability Insurance

Cyber liability insurance is increasingly important for global SMEs in today's digital age. This coverage protects businesses from cyber threats such as data breaches, ransomware attacks, and network security failures. It can help cover the costs of data recovery, notification expenses, and legal fees associated with cyber incidents, safeguarding SMEs against the financial consequences of cyber risks.In conclusion, a well-rounded liability insurance package for global SMEs should include a combination of general liability, professional liability, product liability, and cyber liability coverage to address a wide range of potential risks and liabilities.

By understanding the significance of each type of coverage and customizing your insurance package to meet your business's specific needs, you can protect your SME from unforeseen challenges and thrive in today's competitive marketplace.

Customization Process for Liability Insurance Packages

When customizing liability insurance packages for SMEs, several important steps are involved to ensure that the coverage meets the specific needs and risks of the business. This process typically begins with a thorough assessment of the company's operations and potential exposures.

Risk Assessment and Analysis

- Insurance providers conduct a detailed risk assessment to identify the unique risks faced by the SME.

- Factors such as the industry in which the business operates, the size of the company, the number of employees, and the geographical location are considered.

- By analyzing these factors, insurance agents can tailor the coverage to address the specific risks that the SME faces.

Tailoring Coverage Options

- Based on the risk assessment, insurance agents work with the SME to customize coverage options that best suit their needs.

- This may involve adding or modifying coverage for certain risks, such as product liability, professional liability, or cyber liability.

- Insurance agents ensure that the coverage limits and deductibles are set at appropriate levels to provide adequate protection without unnecessary costs.

Role of Insurance Agents or Brokers

- Insurance agents play a crucial role in the customization process by acting as intermediaries between the SME and the insurance provider.

- They have the expertise to assess the risks faced by the business and recommend suitable coverage options.

- Insurance brokers can also negotiate with multiple insurance companies to find the best coverage at competitive rates for the SME.

Final Thoughts

As we wrap up our discussion on tailored liability insurance packages for global SMEs, we reflect on the key insights shared and emphasize the critical role of customized insurance solutions in safeguarding businesses worldwide.

Questions Often Asked

What are the key benefits of customized liability insurance for global SMEs?

Customized liability insurance offers tailored coverage that addresses the unique risks faced by global SMEs, providing comprehensive protection specific to their industry and geographical location.

How does cyber liability insurance benefit global SMEs?

Cyber liability insurance is crucial for global SMEs as it protects against cyber risks and data breaches, safeguarding sensitive information and financial stability in an increasingly digital world.

What role do insurance agents play in customizing liability insurance packages for SMEs?

Insurance agents assist in customizing insurance packages by assessing risks, understanding business needs, and recommending suitable coverage options to ensure comprehensive protection for global SMEs.