“Best Small Business Liability Insurance with Online Quotes” sets the stage for this informative guide, offering readers valuable insights into the world of small business insurance. From understanding the basics to exploring the importance and factors to consider, this guide covers it all.

As we delve deeper into the realm of small business liability insurance, readers will gain a clear understanding of how online quotes play a crucial role in securing the best coverage for their business.

Understanding Small Business Liability Insurance

Small business liability insurance is a type of insurance coverage that helps protect small businesses from financial losses resulting from lawsuits or claims filed against them by third parties. This insurance can cover legal fees, settlements, and other costs associated with liability claims.

Types of Liability Coverage

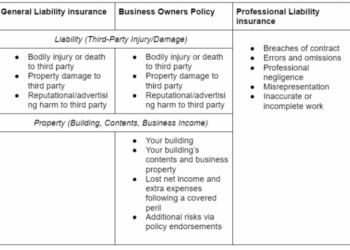

- General Liability Insurance: Provides coverage for claims of bodily injury, property damage, and advertising injury.

- Professional Liability Insurance: Also known as Errors and Omissions insurance, it covers claims of negligence related to professional services.

- Product Liability Insurance: Protects businesses from claims related to products they manufacture or sell.

- Employment Practices Liability Insurance: Covers claims related to wrongful termination, discrimination, or harassment in the workplace.

Examples of When Small Businesses May Need Liability Insurance

- A customer slips and falls in a small business establishment, resulting in a lawsuit for medical expenses.

- A small business consultant provides advice that leads to financial losses for a client, who then files a lawsuit for damages.

- A product sold by a small business causes harm to a consumer, leading to a product liability claim.

Importance of Liability Insurance for Small Businesses

Liability insurance is crucial for small businesses as it provides protection against various risks and potential financial losses.

Significance of Having Liability Insurance

- Protects Against Lawsuits: Liability insurance helps cover legal expenses and settlements in case a business is sued for property damage or bodily injury.

- Enhances Credibility: Having liability insurance can boost a small business's credibility and trustworthiness among clients and partners.

- Compliance with Contracts: Many clients and vendors require small businesses to have liability insurance before entering into contracts.

Risks of Operating Without Liability Coverage

- Financial Losses: Without liability insurance, small businesses may have to pay out of pocket for legal fees, settlements, or damages, leading to significant financial strain.

- Reputation Damage: A lawsuit or liability claim can tarnish a small business's reputation, affecting its relationships with customers and stakeholders.

- Business Closure: In extreme cases, the financial burden of a liability claim can force a small business to shut down operations.

Protection from Financial Losses

- Coverage for Legal Expenses: Liability insurance can help cover legal defense costs, settlement payments, and court-ordered judgments.

- Property Damage and Bodily Injury: Small businesses are protected from liabilities arising from damage to third-party property or injuries caused to individuals.

- Piece of Mind: With liability insurance in place, small business owners can focus on running their business without the constant worry of potential lawsuits draining their resources.

Factors to Consider When Choosing the Best Small Business Liability Insurance

When selecting the best small business liability insurance, there are several key factors that small business owners should consider. It's important to compare coverage options from different insurance providers and carefully evaluate each policy to ensure it meets the specific needs of the business.

Here is a checklist to help guide small business owners in choosing the best liability insurance:

Coverage Options

- General Liability Coverage: This provides protection against claims of bodily injury, property damage, and personal injury.

- Professional Liability Coverage: Also known as errors and omissions insurance, this covers claims of negligence or inadequate work.

- Product Liability Coverage: This protects against claims related to products sold or manufactured by the business.

- Cyber Liability Coverage: In the digital age, this coverage protects against data breaches and cyber-attacks.

Premium Costs and Deductibles

- Compare premium costs from different insurance providers to ensure you are getting the best value for your money.

- Consider the deductible amount that you would need to pay out of pocket before the insurance coverage kicks in.

Claims Process and Customer Service

- Research the claims process of each insurance provider to understand how efficiently and effectively claims are handled.

- Consider the level of customer service provided by the insurance company and how responsive they are to inquiries and concerns.

Policy Limits and Exclusions

- Understand the policy limits, which are the maximum amount the insurance company will pay out for a claim.

- Be aware of any exclusions in the policy that may leave your business vulnerable to certain risks.

Online Quotes for Small Business Liability Insurance

Obtaining online quotes for small business liability insurance is a convenient and efficient way for business owners to compare different coverage options and find the best policy to protect their business.

Step-by-Step Guide on Requesting and Comparing Online Insurance Quotes

- Research Insurance Providers: Start by researching reputable insurance providers that offer small business liability insurance.

- Visit Insurance Websites: Go to the websites of the insurance providers you are interested in and look for their online quote tools.

- Fill Out Information: Enter the required information about your business, such as the industry you are in, number of employees, revenue, and coverage needs.

- Review Quotes: Once you have submitted your information, you will receive online quotes from the insurance providers. Review the quotes carefully to compare coverage options and premiums.

- Consult with an Agent: If you have questions or need clarification on any aspect of the quotes, don't hesitate to contact an insurance agent for assistance.

Advantages and Disadvantages of Using Online Platforms to Obtain Insurance Quotes

- Advantages:

- Convenience: Online quotes can be obtained at any time, allowing business owners to compare options without the need for in-person meetings.

- Cost-Effective: Online quotes often result in lower premiums due to reduced overhead costs for insurance providers.

- Quick Comparisons: Business owners can quickly compare multiple quotes and coverage options to find the best policy for their needs.

- Disadvantages:

- Lack of Personalization: Online quotes may not take into account specific details of your business that could affect coverage needs.

- Limited Guidance: Without speaking to an insurance agent directly, business owners may miss out on valuable advice and guidance in selecting the right policy.

- Potential Errors: Inputting incorrect information during the online quote process could result in inaccurate quotes or coverage recommendations.

Wrap-Up

In conclusion, navigating the world of small business liability insurance can seem daunting, but armed with the right knowledge and tools, businesses can protect themselves from potential risks and losses. This guide serves as a roadmap to help small business owners make informed decisions when it comes to choosing the best insurance coverage.

FAQ Overview

What is small business liability insurance?

Small business liability insurance provides coverage for legal costs and damages a business may be responsible for in case of third-party claims.

How can small businesses benefit from liability insurance?

Liability insurance protects small businesses from financial losses due to lawsuits, property damage, or injuries that may occur during business operations.

What factors should small business owners consider when choosing liability insurance?

Key factors include coverage options, premium costs, deductible amounts, and the reputation of the insurance provider.

How can small business owners obtain online quotes for liability insurance?

Small business owners can visit insurance provider websites, fill out online forms with their business details, and receive quotes instantly.

What are the advantages of using online platforms to obtain insurance quotes?

Online platforms offer convenience, quick comparison of multiple quotes, and easy access to information to help small business owners make informed decisions.