"Best Digital Platforms to Shop for Business Insurance Globally” sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

"The importance of digital platforms for shopping for business insurance globally cannot be overstated. In today's fast-paced world, businesses need efficient and effective ways to secure their insurance needs. This guide delves into the top digital platforms that cater to this demand, highlighting key features, benefits, and success stories.

Dive in to discover the future of business insurance shopping!"

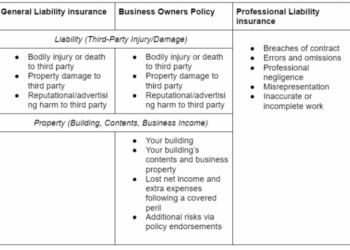

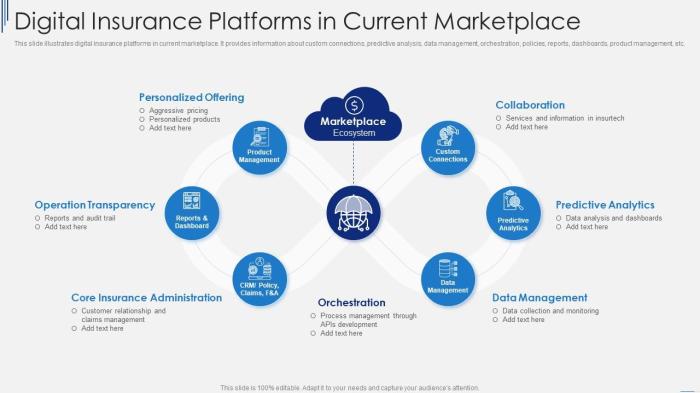

Overview of Business Insurance Platforms

Business insurance platforms have revolutionized the way companies shop for insurance globally. These digital platforms offer a wide range of benefits and features that make them a preferred choice for businesses of all sizes.

Key Features of Business Insurance Platforms

- Convenient Comparison Tools: Digital platforms allow businesses to compare different insurance policies quickly and easily, helping them find the best coverage at competitive prices.

- Customized Solutions: Many platforms offer tailored insurance solutions based on the specific needs and risks of each business, ensuring comprehensive coverage.

- Instant Quotes: Businesses can receive instant insurance quotes online, saving time and eliminating the need for lengthy negotiations with insurance agents.

Benefits of Using Digital Platforms for Business Insurance

- Time-Saving: Businesses can shop for insurance at their convenience, without the need for in-person meetings or phone calls, saving valuable time.

- Cost-Effective: Digital platforms often offer competitive rates and discounts, helping businesses save money on their insurance premiums.

- Transparency: Businesses can access all policy details and terms online, ensuring transparency and clarity in their insurance coverage.

Top Digital Platforms for Business Insurance

When it comes to shopping for business insurance globally, there are several top digital platforms that offer a wide range of coverage options and user-friendly experiences. Let's take a closer look at some of the best platforms available:

1. CoverWallet

CoverWallet is a popular digital platform that provides business insurance solutions for small to medium-sized businesses. They offer a simple online application process and personalized quotes based on your specific needs. CoverWallet also provides excellent customer support and a variety of coverage options to choose from.

2. Simply Business

Simply Business is another leading platform for business insurance, catering primarily to small businesses and freelancers. They offer a streamlined online experience, competitive pricing, and a wide range of insurance products, including general liability, professional indemnity, and more.

3. Next Insurance

Next Insurance is known for its innovative approach to business insurance, particularly targeting industries such as construction, fitness, and beauty. Their platform offers fast quotes, flexible payment options, and customizable coverage plans to meet the unique needs of different businesses.

4. Hiscox

Hiscox is a well-established insurance provider that also offers digital solutions for business insurance. They are known for their comprehensive coverage options, specialized policies for specific industries, and a user-friendly online platform. Hiscox caters to a wide range of businesses, from startups to large corporations.

5. Insureon

Insureon is a digital insurance agency that connects businesses with top-rated insurance carriers to provide customized coverage solutions

Customization and Tailored Solutions

When it comes to business insurance platforms, the level of customization and tailored solutions available can vary significantly. Businesses have the opportunity to personalize their insurance plans to suit their specific needs, providing them with greater flexibility and control over their coverage options.

Advantages of Customized Insurance Solutions

- Customized insurance solutions allow businesses to tailor their coverage to match their unique risks and requirements.

- By opting for personalized plans, businesses can avoid paying for unnecessary coverage that may be included in standard packages.

- Businesses can also adjust their insurance policies as their needs change over time, ensuring they always have adequate protection.

- Customized solutions often come with dedicated support and services, providing businesses with a more personalized and responsive experience.

- Overall, customized insurance solutions offer businesses greater peace of mind and confidence in their coverage.

Customer Support and Assistance

Customer support services play a crucial role in the overall experience of businesses shopping for insurance on digital platforms. Let's explore how these platforms offer assistance to their customers.

24/7 Live Chat and Phone Support

Many of the top digital platforms for business insurance provide 24/7 live chat and phone support for immediate assistance. This ensures that businesses can get their queries addressed promptly and efficiently.

Personalized Account Managers

Some platforms offer personalized account managers to guide businesses through the insurance shopping process. These account managers provide tailored solutions and recommendations based on the specific needs of each business.

Online Knowledge Base and Resources

Most digital platforms have an online knowledge base with articles, FAQs, and resources to help businesses understand different insurance options. This self-service option can be valuable for businesses looking to educate themselves before making a decision.

Claims Assistance and Support

In the event of a claim, these platforms provide assistance and support to help businesses navigate the claims process smoothly. This can include guiding businesses on documentation requirements, timelines, and other important details.

Exceptional Customer Support Experiences

"I had a complex insurance need for my business, and the customer support team went above and beyond to find a customized solution that fit perfectly. Their dedication and expertise truly set them apart."

Business Owner

"When I had questions about a specific policy, the live chat support on the platform was incredibly helpful and responsive. They made the entire process so much easier for me."

Entrepreneur

Closure

"In conclusion, exploring the realm of business insurance through digital platforms opens up a world of possibilities for businesses worldwide. From customization to customer support, these platforms offer a comprehensive solution to insurance needs. Embrace the digital age and elevate your insurance shopping experience with the best platforms available."

Question Bank

What are the benefits of using digital platforms for business insurance compared to traditional methods?

Using digital platforms for business insurance offers convenience, accessibility, and often a wider range of options compared to traditional methods. Businesses can easily compare policies, obtain quotes, and make informed decisions online.

How can businesses personalize their insurance plans on these platforms?

Businesses can personalize their insurance plans on these platforms by selecting coverage options that best suit their needs, adjusting policy limits, and adding specific endorsements or riders tailored to their industry or risks.

What level of customer support can businesses expect from these digital platforms?

These digital platforms typically offer 24/7 customer support through various channels such as live chat, email, or phone. Businesses can receive assistance with policy inquiries, claims processing, and general insurance-related queries.