Embarking on the journey of “All-in-One Liability Insurance for Small Business Operations,” we delve into a world where comprehensive coverage is key for the success and security of small enterprises. The intricacies of liability insurance unfold, promising insights that will surely captivate our audience.

In the subsequent sections, we will explore the different facets of this vital insurance solution, shedding light on its benefits, customization options, and cost considerations for small businesses.

Overview of All-in-One Liability Insurance for Small Business Operations

Small businesses face various risks and uncertainties in their day-to-day operations, making liability insurance essential for protecting their financial well-being. All-in-one liability insurance is a comprehensive policy that combines different types of liability coverage into a single plan, offering convenience and cost-effectiveness for small business owners.

Define the concept of all-in-one liability insurance

All-in-one liability insurance is a type of insurance policy that bundles together multiple forms of liability coverage in a single plan. This can include general liability, professional liability, product liability, and cyber liability insurance, among others. By consolidating these coverages into one policy, small business owners can simplify their insurance management and ensure they have adequate protection against a wide range of risks.

Explain the importance of having comprehensive liability coverage for small businesses

Small businesses are vulnerable to lawsuits and claims that can arise from accidents, errors, or negligence in their operations. Without proper liability coverage, these legal expenses and settlement costs can quickly drain a business's finances and jeopardize its survival. Comprehensive liability insurance provides a safety net for small businesses, shielding them from the financial implications of unforeseen events and legal disputes.

Discuss the benefits of consolidating different types of liability insurance into a single policy

By opting for an all-in-one liability insurance policy, small business owners can benefit from streamlined coverage management, reduced administrative burden, and potential cost savings. Instead of juggling multiple policies from different insurers, they can have all their liability needs addressed under one comprehensive plan.

This not only simplifies the insurance process but also ensures that there are no coverage gaps or overlaps, providing peace of mind for business owners.

Types of Coverage Included in All-in-One Liability Insurance

Liability insurance for small businesses typically includes various types of coverage to protect business owners from potential risks. Each type of coverage serves a specific purpose in safeguarding the business and its assets.

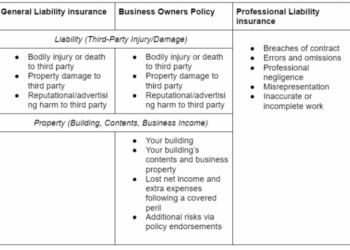

General Liability Insurance

General liability insurance covers a wide range of common risks that small businesses face, such as third-party bodily injury, property damage, and advertising injury claims. For example, if a customer slips and falls in your store, general liability insurance would cover their medical expenses and any legal fees if they decide to sue.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects small businesses that provide services or advice from claims of negligence or failure to perform professional duties. For instance, if a client alleges that your accounting firm made a costly error in their financial statements, professional liability insurance would cover legal fees and damages.

Product Liability Insurance

Product liability insurance is crucial for businesses that manufacture, distribute, or sell products. This coverage protects against claims related to injuries or damages caused by a faulty product. For example, if a consumer becomes ill after using a contaminated food product from your restaurant, product liability insurance would cover legal costs and any settlements.

Cyber Liability Insurance

Cyber liability insurance helps small businesses recover from data breaches, cyberattacks, and other cyber incidents. This coverage can assist with the costs of notifying affected customers, restoring data, and defending against lawsuits. If a hacker gains access to your customer database and steals sensitive information, cyber liability insurance would cover the expenses associated with managing the breach.

Employment Practices Liability Insurance

Employment practices liability insurance protects small businesses from claims related to wrongful termination, discrimination, harassment, or other employment-related issues. For example, if a former employee sues your business for discrimination during the hiring process, employment practices liability insurance would cover legal expenses and any settlements.

Customization and Tailoring Options

When it comes to small businesses, having the right insurance coverage is crucial to protect against unexpected risks. All-in-one liability insurance policies offer a convenient solution, but customization options allow small business owners to tailor their coverage to suit their specific needs and operations.

Customizing Coverage

- Small business owners can customize their all-in-one liability insurance by selecting specific coverage limits based on their industry, size, and unique risks.

- They can also add additional coverage options such as cyber liability, professional liability, or umbrella insurance to enhance their protection.

- Customizing coverage allows businesses to ensure they are adequately protected without paying for unnecessary coverage.

Tailoring Options

- The process of tailoring coverage involves working closely with an insurance agent or broker to assess the business's risks and determine the appropriate coverage levels.

- Business owners can choose to increase or decrease coverage limits, add endorsements, or adjust deductibles to create a policy that fits their specific needs.

- Tailoring options ensure that small businesses have comprehensive coverage that addresses their unique risks and exposures.

Ensuring Adequate Coverage

- Small business owners should regularly review and update their insurance policies to ensure they have adequate coverage as their business grows and evolves.

- It is essential to communicate openly with insurance providers to discuss any changes in operations, new risks, or expansions that may impact coverage needs.

- Working with an experienced insurance professional can help small business owners navigate the customization and tailoring process to ensure they have the right coverage in place.

Cost Considerations and Factors Affecting Premiums

When it comes to all-in-one liability insurance for small business operations, the cost of the policy is a crucial factor to consider. Several elements can impact the premiums associated with this type of coverage, affecting the overall financial burden on a business.

Understanding these factors and exploring strategies to manage costs while maintaining adequate coverage is essential for small business owners.

Factors Affecting Premiums

- The type of business: Certain industries are deemed riskier than others, leading to higher premiums. For example, a construction company may face more liabilities than a consulting firm, resulting in different costs for insurance coverage.

- Business size and revenue: The scale of operations and annual revenue can influence premium rates. Larger businesses with higher revenues might pay more for coverage due to increased exposure to risks.

- Claims history: A track record of frequent or costly claims can raise premiums, as it suggests a higher likelihood of future claims. Maintaining a clean claims history can help keep premiums in check.

- Coverage limits and deductibles: Opting for higher coverage limits or lower deductibles can lead to higher premiums. Small businesses should carefully assess their needs and strike a balance between adequate coverage and affordability.

Managing Premiums Effectively

- Shop around: Compare quotes from multiple insurance providers to find the best rates for all-in-one liability insurance. Different insurers might offer varying premiums for similar coverage.

- Bundling policies: Consider bundling multiple types of insurance, such as property and liability coverage, with the same provider. Insurers often offer discounts for bundled policies, helping to reduce overall costs.

- Risk management practices: Implement risk mitigation strategies within the business to lower the chances of claims. This proactive approach can demonstrate to insurers that the business is committed to reducing risks, potentially leading to lower premiums.

- Review coverage annually: Regularly reassess the business's insurance needs and adjust coverage levels accordingly. As the business evolves, its insurance requirements may change, impacting premium costs.

Closing Summary

As we wrap up our discussion on “All-in-One Liability Insurance for Small Business Operations,” we reflect on the significance of consolidating various coverage types into a single policy. This holistic approach not only streamlines insurance management but also ensures robust protection for small business ventures.

Helpful Answers

What does all-in-one liability insurance entail?

All-in-one liability insurance combines different types of liability coverage into a single policy, offering comprehensive protection for small businesses.

How can small businesses tailor their liability insurance policies?

Small businesses can customize their policies by selecting specific coverage options to align with their unique needs and risks.

What factors influence the cost of all-in-one liability insurance?

Factors such as business size, industry risk, coverage limits, and claims history can impact the cost of premiums for this insurance.

How can small businesses manage insurance premiums effectively?

Small businesses can manage premiums by regularly assessing their coverage needs, implementing risk management strategies, and comparing quotes from different insurers.

Are there ways to reduce insurance costs without compromising coverage quality?

Yes, small businesses can lower insurance costs by bundling policies, implementing safety measures, and reviewing their coverage periodically to ensure it meets their evolving needs.