Delve into the realm of business insurance with a focus on “Comprehensive Coverage: General vs Professional Business Insurance.” This narrative unfolds a compelling tale, drawing readers in with its twists and insights.

The following paragraphs offer a detailed exploration of the topic, shedding light on the nuances of general and professional business insurance coverage.

General Business Insurance Coverage

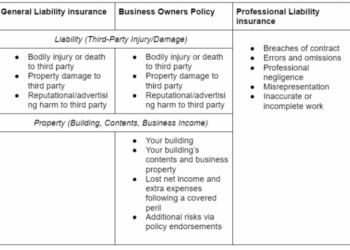

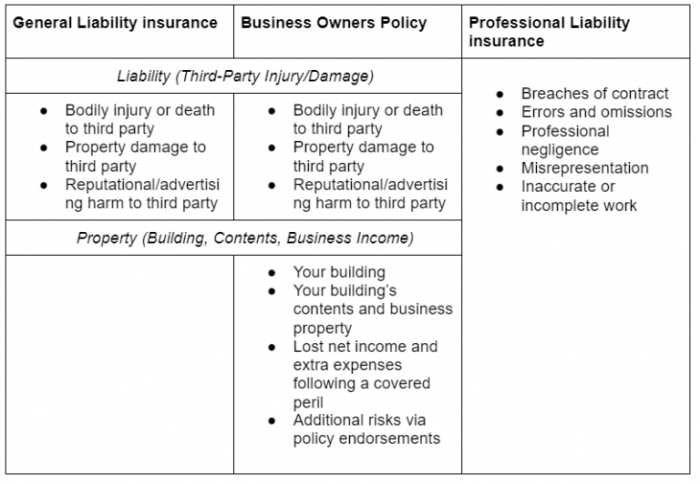

General business insurance provides a broad level of coverage for a variety of risks that businesses may face.

Key Components of General Business Insurance

- Property Insurance: Protects against damage or loss of physical assets such as buildings, equipment, and inventory.

- Liability Insurance: Covers costs associated with legal claims for injuries or property damage caused by the business.

- Business Interruption Insurance: Helps cover lost income and expenses if the business is unable to operate due to a covered event.

- Commercial Auto Insurance: Provides coverage for vehicles used for business purposes.

Examples of Risks Covered

- Natural Disasters: Such as fires, floods, or earthquakes that can damage property.

- Employee Injuries: Coverage for medical expenses and lost wages if an employee is injured on the job.

- Lawsuits: Legal expenses and settlements for claims of negligence or other liabilities.

Comparison of Coverage Limits

General business insurance typically has lower coverage limits compared to professional business insurance. This is because professional liability insurance is tailored to cover specific risks related to professional services, which may require higher coverage limits to protect against potential financial losses.

Professional Business Insurance Coverage

Professional business insurance is a type of coverage designed to protect businesses and professionals from specific risks and liabilities that are unique to their industry or profession. While general business insurance covers more common risks like property damage and bodily injury, professional business insurance focuses on risks related to the services or advice provided by professionals.

Specific Risks Covered

Professional business insurance typically covers risks such as malpractice, errors, omissions, negligence, misrepresentation, and other professional liabilities that may arise from the services or advice provided by professionals. This type of insurance is crucial for businesses where mistakes or oversights could result in financial losses or legal claims.

- Malpractice: Professional business insurance protects against claims of negligence or inadequate service that result in harm to a client.

- Errors and Omissions: This coverage specifically protects against claims of errors, omissions, or failure to perform professional services.

- Negligence: Insurance can help cover legal expenses and damages if a professional is found negligent in their duties.

- Misrepresentation: Protection is provided in case of claims related to inaccurate or misleading information provided by a professional.

Errors and omissions insurance, also known as E&O insurance, is a critical component of professional business insurance. It specifically covers claims of mistakes or negligence in the professional services provided, offering financial protection and peace of mind.

Differences in Coverage

In the world of business insurance, understanding the differences in coverage between general and professional policies is crucial for safeguarding your company's assets and operations.General business insurance typically provides broad coverage for common risks faced by most businesses, such as property damage, liability claims, and employee injuries.

On the other hand, professional business insurance is tailored to cover specific risks associated with professional services, such as errors and omissions, malpractice, or negligence claims.

Scenarios where each type of insurance would be necessary

- General business insurance would be necessary for a retail store that needs protection against property damage from fire or theft, as well as liability claims from customers slipping and falling on the premises.

- Professional business insurance, on the other hand, would be essential for a law firm that requires coverage for errors or omissions in legal advice provided to clients, protecting them from potential malpractice lawsuits.

Examples of businesses that would benefit more from general insurance over professional insurance or vice versa

- An independent contractor or freelancer may benefit more from professional business insurance to protect against claims of professional negligence, while a small restaurant may find general business insurance more suitable for covering risks like food spoilage or customer injuries.

- A graphic design agency specializing in creating marketing materials for clients would likely require professional business insurance to protect against claims of copyright infringement, while a landscaping company might opt for general business insurance to cover equipment damage and liability claims from accidental property damage.

Cost Considerations

When it comes to business insurance, cost is a significant factor that business owners need to consider. The cost of insurance can vary based on several factors, including the type of coverage and the insurance provider. In this section, we will explore how the cost of general business insurance is determined, discuss the factors that influence the cost of professional business insurance, and compare the overall cost-effectiveness of general versus professional business insurance.

Cost of General Business Insurance

General business insurance premiums are typically determined based on the size and nature of the business, the location, coverage limits, deductible amounts, and claims history. Small businesses with fewer employees and lower risk factors may pay lower premiums compared to larger businesses with higher risks.

The type of coverage selected, such as property insurance, liability insurance, or business interruption insurance, also plays a role in determining the cost.

- The size and nature of the business

- Location of the business

- Coverage limits and deductible amounts

- Claims history

Factors Influencing the Cost of Professional Business Insurance

Professional business insurance, also known as errors and omissions insurance, is designed to protect businesses from claims of negligence or inadequate work. The cost of professional business insurance is influenced by factors such as the type of profession, the level of coverage needed, the size of the business, claims history, and the business's risk profile.

Industries with higher risks of lawsuits or claims may face higher premiums for professional liability insurance.

- Type of profession

- Level of coverage needed

- Size of the business

- Claims history and risk profile

Comparison of Cost-Effectiveness

When comparing the cost-effectiveness of general versus professional business insurance, it is essential to consider the specific needs and risks of the business. While general business insurance provides broad coverage for property damage, liability claims, and other common risks, professional business insurance offers specialized protection against claims related to professional services.

The cost-effectiveness of each type of insurance will depend on the unique circumstances of the business, the level of risk exposure, and the likelihood of claims.

- General business insurance offers broad coverage for common risks

- Professional business insurance provides specialized protection for professional services

- Cost-effectiveness depends on the business's needs, risk exposure, and likelihood of claims

Final Review

As we reach the end of this discussion, let's recap the essential points covered in the comparison between general and professional business insurance. The journey through the intricacies of business coverage concludes with a clear understanding of the differences and considerations involved.

Frequently Asked Questions

What factors influence the cost of professional business insurance?

Factors such as the industry type, business size, coverage limits, and claims history can impact the cost of professional business insurance.

When would a business benefit more from general insurance over professional insurance?

Businesses with standard risks and broader coverage needs may find general insurance more suitable compared to professional insurance that caters to specific liabilities.

What is errors and omissions insurance within professional business insurance?

Errors and omissions insurance, also known as professional liability insurance, protects businesses from claims related to professional mistakes, negligence, or failure to perform services.