"Shop Smart: Business Insurance Options for Freelancers" sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a casual formal language style and brimming with originality from the outset.

"Shop Smart: Business Insurance Options for Freelancers" dives deep into the world of insurance for freelancers, shedding light on the crucial aspects that every freelancer should consider.

Overview of Business Insurance for Freelancers

Business insurance is a crucial investment for freelancers as it provides financial protection against unexpected events that could jeopardize their work and livelihood. It helps freelancers mitigate risks and uncertainties that come with running a business independently.

Types of Business Insurance Options

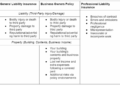

- General Liability Insurance: Protects freelancers from third-party claims of bodily injury, property damage, or advertising injury.

- Professional Liability Insurance: Also known as Errors and Omissions Insurance, it covers freelancers against claims of negligence, errors, or omissions in their work.

- Property Insurance: Safeguards freelancers' business assets, such as equipment, tools, and inventory, against damage or loss due to theft, fire, or other covered perils.

- Workers' Compensation Insurance: Covers medical expenses and lost wages for freelancers in case of work-related injuries or illnesses.

Examples of Business Insurance Protection

For instance, if a freelance web designer accidentally uses copyrighted images on a client's website, Professional Liability Insurance can cover legal fees and damages resulting from a copyright infringement claim.

In another scenario, if a freelance photographer's camera equipment is stolen, Property Insurance can help replace the stolen gear, minimizing the financial impact on the business.

General Liability Insurance

General liability insurance provides coverage for freelancers in case they are held liable for bodily injury, property damage, or personal and advertising injury to a third party.

What Does General Liability Insurance Cover for Freelancers?

- Medical expenses for injuries suffered by a third party on your premises

- Legal fees and settlements for lawsuits related to property damage caused by your business

- Protection against claims of slander, libel, copyright infringement, or false advertising

Why Should Freelancers Consider Having General Liability Insurance?

Having general liability insurance can protect freelancers from financial losses that may arise from unexpected accidents or lawsuits. It provides peace of mind and ensures that your personal assets are not at risk in case of a liability claim.

Examples of Situations Where General Liability Insurance Can Be Beneficial for Freelancers

- If a client visits your home office and trips over a loose cable, resulting in injuries, general liability insurance can cover their medical expenses.

- If you accidentally damage a client's property while working on-site, general liability insurance can help cover the costs of repair or replacement.

- In the event that a competitor accuses you of making false claims about their products in your advertising, general liability insurance can cover legal fees for defending against a defamation lawsuit.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is a type of coverage that provides protection for freelancers against claims of negligence or failure to perform professional duties. It is important for freelancers who provide advice, expertise, or professional services to clients.

Difference between General Liability and Professional Liability Insurance

- General liability insurance covers claims related to property damage, bodily injury, and advertising injury caused by the freelancer's business operations.

- Professional liability insurance, on the other hand, specifically covers claims of errors, omissions, or negligence in the services provided by the freelancer.

What Professional Liability Insurance Typically Covers

- Legal defense costs

- Settlements or judgments

- Claims related to professional errors or negligence

- Claims of misrepresentation or violation of good faith

Real-life Examples of Professional Liability Insurance in Action

- A graphic designer is sued by a client for using copyrighted images without permission. The designer's professional liability insurance covers the legal costs and settlement.

- A consultant provides incorrect advice to a client, resulting in financial loss. The consultant's professional liability insurance covers the client's damages and legal expenses.

Property Insurance

When it comes to freelancers who work from home, property insurance is essential for protecting their assets and business operations. This type of insurance provides coverage for the physical space where work is conducted, as well as any equipment or inventory within that space.Property insurance for freelancers can cover a range of scenarios, including damage to the home office due to fire, theft, or natural disasters.

It can also extend to cover business equipment such as computers, printers, and other tools necessary for work. Additionally, property insurance can provide coverage for any inventory or products stored at the home office.

Importance of Property Insurance for Freelancers

- Protection for home office space from unforeseen events like fire or theft

- Coverage for business equipment and tools essential for work

- Protection for inventory and products stored at the home office

Examples of Coverage Provided by Property Insurance

- Reimbursement for repairs or replacement of damaged home office space

- Compensation for stolen or damaged business equipment

- Coverage for lost income due to business interruption caused by covered events

Common Misconceptions About Property Insurance for Freelancers

-

Myth: Homeowner's insurance provides sufficient coverage for a home-based business.

In reality, homeowner's insurance typically does not cover business-related property damage or losses.

-

Myth: Property insurance is only for businesses with a physical storefront.

Freelancers who work from home can also benefit from property insurance to protect their business assets.

-

Myth: Property insurance is unnecessary if the home office is small or low in value.

Regardless of the size or value of the home office, property insurance can provide essential protection for freelancers.

Concluding Remarks

"Shop Smart: Business Insurance Options for Freelancers" wraps up this insightful discussion with a compelling summary that highlights the key takeaways and leaves readers with a newfound understanding of business insurance for freelancers.

Expert Answers

"What does business insurance cover for freelancers?"

"Business insurance typically covers liabilities, property damage, legal fees, and other risks that freelancers may face in their work."

"Why is professional liability insurance important for freelancers?"

"Professional liability insurance protects freelancers against claims of negligence, errors, or omissions in their work, providing financial coverage for legal expenses and settlements."

"What misconceptions should freelancers be aware of regarding property insurance?"

"Freelancers should be aware that property insurance may not always cover business equipment used at home, and they might need additional coverage for valuable equipment."