Embark on a journey to secure your company with budget-friendly hazard insurance. This guide delves into the importance of protecting your business from unforeseen risks and the various types of policies available to safeguard your assets.

Learn how to navigate the world of hazard insurance with ease and make informed decisions that will benefit your company in the long run.

Importance of Hazard Insurance

When it comes to protecting your company from unexpected events that could potentially derail your operations, hazard insurance plays a crucial role. This type of insurance is designed to provide coverage for a wide range of hazards that could cause damage to your business property or assets.

Examples of Hazards Covered by Hazard Insurance

- Natural disasters such as earthquakes, floods, hurricanes, and wildfires

- Man-made hazards like vandalism, theft, and accidents

- Damage from explosions, riots, or civil disturbances

Benefits of Having Hazard Insurance for a Company

- Financial Protection: Hazard insurance can help cover the cost of repairs or replacement of damaged property, reducing the financial burden on your company.

- Business Continuity: With hazard insurance in place, your company can recover quickly from unexpected events and continue operations without significant disruptions.

- Peace of Mind: Knowing that your company is protected against a variety of hazards can give you peace of mind and allow you to focus on growing your business without worrying about potential risks.

Types of Hazard Insurance Policies

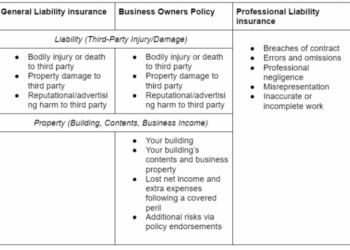

When it comes to protecting your company from potential risks and hazards, there are several types of hazard insurance policies available to choose from. Each type offers different coverage limits and exclusions, so it's important to understand the features of each policy to make an informed decision.

1. Property Insurance

Property insurance provides coverage for damage or loss to the physical assets of your company, such as buildings, equipment, and inventory. It typically includes protection against hazards like fire, theft, vandalism, and natural disasters. However, it may have exclusions for certain types of hazards, such as earthquakes or floods.

2. Liability Insurance

Liability insurance protects your company from claims or lawsuits filed by third parties for bodily injury or property damage caused by your business operations. It covers legal fees, settlements, and judgments. However, it may not cover intentional acts or punitive damages.

3. Business Interruption Insurance

Business interruption insurance helps cover the loss of income and extra expenses if your company is unable to operate due to a covered hazard, such as a fire or natural disaster. It can help with ongoing expenses like payroll and rent during the downtime.

However, it usually has a waiting period before coverage kicks in.

4. Commercial Auto Insurance

Commercial auto insurance provides coverage for vehicles owned or used by your company for business purposes. It includes protection against accidents, theft, and property damage. However, it may have exclusions for certain types of vehicles or uses.

5. Workers' Compensation Insurance

Workers' compensation insurance is mandatory in most states and provides coverage for medical expenses and lost wages for employees who are injured or become ill on the job. It also protects your company from lawsuits related to workplace injuries. However, it may not cover injuries that occur outside of work or are self-inflicted.By understanding the different types of hazard insurance policies available, companies can choose the most suitable coverage to protect their assets, operations, and employees from unforeseen risks and hazards.

Budget-Friendly Options

When it comes to finding affordable hazard insurance for your company, there are several strategies you can implement to reduce costs without sacrificing coverage. By exploring budget-friendly options and providers, you can protect your business without breaking the bank.

Comparison Shop for Quotes

One of the best ways to secure budget-friendly hazard insurance is by comparing quotes from different providers. By obtaining multiple quotes, you can identify the most cost-effective option that meets your coverage needs.

Consider Bundling Policies

Many insurance providers offer discounts for bundling multiple policies together. Consider bundling your hazard insurance with other types of insurance, such as property or liability insurance, to save on overall costs.

Opt for Higher Deductibles

Choosing a higher deductible can help lower your insurance premiums. While you'll have to pay more out of pocket in the event of a claim, this can significantly reduce your monthly or annual insurance costs.

Explore Government Programs

Some government programs and initiatives offer hazard insurance at reduced rates for qualifying businesses. Explore these options to see if your company is eligible for any cost-saving programs.

Risk Assessment and Mitigation

Conducting a risk assessment is crucial for any company to identify potential threats and vulnerabilities that could impact its operations. By understanding these risks, businesses can develop strategies to mitigate them and protect their assets.

Steps in Risk Assessment and Mitigation

When assessing and mitigating risks, companies typically follow a structured approach to ensure thorough analysis and effective solutions. Here are the key steps involved:

- Identify Risks: The first step is to identify all possible risks that could affect the company, including natural disasters, accidents, theft, or cybersecurity breaches.

- Assess Probability and Impact: Evaluate the likelihood of each risk occurring and the potential impact it could have on the business in terms of financial loss, reputation damage, or operational disruptions.

- Develop Risk Mitigation Strategies: Once risks are identified and assessed, companies need to develop specific strategies to mitigate these risks. This may involve implementing safety protocols, investing in security measures, or creating contingency plans.

- Implement Controls: Companies must put in place controls and procedures to minimize the likelihood of risks occurring and reduce their impact if they do occur. This could include training employees, securing physical assets, or using advanced technology solutions.

- Regular Monitoring and Review: Risk assessment is an ongoing process that requires regular monitoring and review to ensure that the identified risks are effectively managed. Companies should update their strategies as needed based on new threats or changes in the business environment.

Role of Hazard Insurance in Risk Mitigation

Hazard insurance plays a crucial role in risk mitigation strategies by providing financial protection against specific hazards or perils. By securing hazard insurance coverage, companies can transfer the financial risk of property damage or loss due to covered events to the insurance provider.

This helps businesses recover quickly after a disaster and continue their operations without facing significant financial setbacks.

Final Review

In conclusion, ensuring your company is risk-proof with budget-friendly hazard insurance is a crucial step towards long-term stability and success. By understanding the nuances of hazard insurance and taking proactive measures to mitigate risks, your company can thrive in a secure environment.

Detailed FAQs

How can hazard insurance benefit my company?

Hazard insurance protects your company from financial losses due to unforeseen events like natural disasters, theft, or vandalism.

What are some strategies to reduce insurance costs?

Companies can lower insurance costs by bundling policies, increasing deductibles, and implementing risk management practices.

How do I choose the most suitable hazard insurance policy?

Consider factors such as coverage limits, exclusions, and premiums to select a policy that aligns with your company's needs and budget.