Embark on a journey exploring the world of business insurance in Asia with the help of modern tools. Discover how these tools can revolutionize the way companies shop for insurance, providing insights and solutions to common challenges faced in the market.

Delve into the different types of business insurance available, understand their significance, and learn about the impact of not having adequate coverage.

Importance of Business Insurance

Business insurance plays a crucial role in protecting companies in Asia from various risks and uncertainties. It provides financial security and peace of mind, allowing businesses to focus on their operations without worrying about potential losses.

Protection Against Natural Disasters

- Business insurance can help companies recover from the devastating effects of natural disasters such as earthquakes, floods, and typhoons, which are common in many Asian countries.

- Without adequate insurance coverage, businesses may struggle to rebuild and resume operations, leading to financial ruin.

Liability Coverage

- Business insurance also offers liability coverage, protecting companies from legal claims and lawsuits due to accidents, injuries, or negligence.

- Without this coverage, businesses risk facing substantial legal costs and compensation payments that could bankrupt them.

Business Interruption Insurance

- In the event of unforeseen circumstances such as a fire or a cyber-attack, business interruption insurance can help cover lost income and ongoing expenses while the business is unable to operate.

- Without this coverage, companies may struggle to stay afloat during a crisis, leading to potential closure.

Types of Business Insurance in Asia

Business insurance in Asia encompasses a wide range of coverage options tailored to meet the needs of different industries and businesses. Understanding the various types of business insurance available is crucial for ensuring comprehensive protection against potential risks and liabilities.

Property Insurance

- Property insurance provides coverage for physical assets such as buildings, equipment, inventory, and furniture against risks like fire, theft, vandalism, and natural disasters.

- Key features include coverage for replacement costs, business interruption, and damage to leased or rented properties.

- Industries such as real estate, manufacturing, retail, and hospitality commonly require property insurance to safeguard their assets.

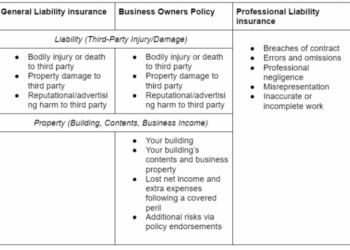

Liability Insurance

- Liability insurance protects businesses from legal liabilities arising from third-party claims of bodily injury, property damage, or other related incidents.

- Key features include coverage for legal defense costs, settlements, and judgments against the business.

- Industries like healthcare, construction, and professional services often opt for liability insurance to mitigate potential risks associated with their operations.

Business Interruption Insurance

- Business interruption insurance compensates businesses for lost income and ongoing expenses when operations are disrupted due to covered perils like fires, natural disasters, or equipment breakdowns.

- Key features include coverage for lost profits, temporary relocation costs, and extra expenses incurred to resume operations.

- Industries vulnerable to significant income loss during downtime, such as hospitality, manufacturing, and transportation, typically invest in business interruption insurance.

Challenges of Shopping for Business Insurance in Asia

When it comes to shopping for business insurance in Asia, businesses face a unique set of challenges that can make the process complex and overwhelming. From navigating different regulations to understanding the intricacies of coverage options, there are several hurdles to overcome in order to secure the right insurance for your business.

Complex Regulatory Landscape

Navigating insurance regulations across different countries in Asia can be a daunting task for businesses looking to purchase insurance coverage. Each country has its own set of rules and requirements when it comes to business insurance, making it crucial for businesses to stay informed and compliant with local regulations.

Failure to do so can result in fines, penalties, or even the invalidation of your insurance coverage.

Variety of Coverage Options

Another challenge businesses face when shopping for business insurance in Asia is the wide variety of coverage options available. From property insurance to liability coverage, businesses need to carefully assess their needs and select the right combination of policies to adequately protect their assets and operations.

Without a clear understanding of the different types of coverage available, businesses may end up underinsured or paying for coverage they don't actually need.

Hidden Exclusions and Limitations

One common pitfall to avoid when selecting business insurance in Asia is overlooking hidden exclusions and limitations in the policy wording. It's important for businesses to thoroughly review the terms and conditions of their insurance policies to ensure they fully understand what is covered and what is not.

Failing to do so can leave businesses vulnerable to unexpected gaps in coverage that could have serious financial consequences.

Language and Cultural Barriers

Language and cultural barriers can also present challenges when shopping for business insurance in Asia. Dealing with insurance providers in a foreign language or navigating cultural differences in business practices can make it difficult for businesses to fully understand their insurance options and make informed decisions.

Working with local insurance brokers or consultants who understand the market can help businesses overcome these barriers and secure the right insurance coverage for their needs.

Modern Tools and Technologies for Shopping and Comparing Business Insurance

In today's digital age, businesses in Asia have access to a wide range of modern tools and technologies that are revolutionizing the way they shop for and compare business insurance policies. These advancements are making the process more efficient, convenient, and transparent for business owners.

Role of AI and Machine Learning

Artificial Intelligence (AI) and machine learning have played a significant role in streamlining the insurance comparison process. These technologies analyze vast amounts of data to provide personalized recommendations based on the specific needs and requirements of a business. By leveraging AI and machine learning algorithms, businesses can quickly compare different insurance policies, coverage options, and premium rates to make informed decisions.

- AI-driven chatbots: Many insurance comparison platforms in Asia use AI-powered chatbots to interact with users and provide real-time assistance in finding the most suitable insurance policies.

- Data analytics tools: With the help of advanced data analytics tools, businesses can easily analyze market trends, pricing models, and risk factors to identify the best insurance options for their specific industry.

- Machine learning algorithms: These algorithms can predict future insurance trends and help businesses optimize their coverage by suggesting relevant policy enhancements or adjustments.

Final Review

In conclusion, embracing modern tools to shop and compare business insurance in Asia is crucial for businesses to thrive and stay protected in a dynamic market. By leveraging these tools, companies can make informed decisions and navigate the complexities of insurance regulations with ease.

Helpful Answers

What are the key benefits of using modern tools to shop for business insurance in Asia?

Modern tools offer convenience, efficiency, and accuracy in comparing insurance policies, helping businesses make well-informed decisions.

How can businesses avoid common pitfalls when selecting business insurance in Asia?

By conducting thorough research, understanding specific insurance needs, and seeking professional advice, businesses can avoid pitfalls and choose the right coverage.

Are there any industry-specific insurance requirements in Asia?

Yes, industries like healthcare, construction, and finance often have unique insurance needs due to the nature of their operations.